A state-backed Japanese fund is frontrunner to rescue Sharp Corp, ahead of a rival approach from Apple supplier Foxconn, but industry insiders question whether it can protect the group in the long term amid cut-throat competition.

Innovation Network Corporation of Japan (INCJ), if successful, would represent the third bailout in as many years for Sharp, known for its liquid crystal display (LCD) technology and super-thin screens.

The INCJ is keen to keep it in domestic hands, and plans to merge it eventually with state-owned rival Japan Display.

Industry experts and some policy advisers are beginning to question whether “old-school” government intervention can help Sharp’s LCD business survive, as competition from Korean and Chinese rivals ratchets up.

“Rather than cutting away the dysfunctional groups, this is about combining the weak part,” said William Saito, an entrepreneur and special adviser to Prime Minister Shinzo Abe’s cabinet office.

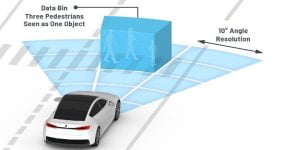

Sharp’s main advantage in LCDs is its IGZO technology, which allows for high definition and thin, touch-screen displays that consume less power than conventional screens.

That has failed to shield it from pricing pressure, and weak finances have prevented it from investing in new technologies even as rivals experiment in newer screen innovations.

Japan Display, formed in a government-backed deal in 2012 from parts of Sony, Toshiba and Hitachi Ltd, was previously seen as a weaker rival.

But it is now doing better, thanks to orders from Apple and Chinese smartphone makers for its “in-cell” screens, which are easier to assemble than other types of high-end LCD screens.

Both Japanese manufacturers face strong competition from Samsung and LG Display, which have been working on OLED (organic light-emitting diode) screens that do not require backlights and can therefore be thinner or curved.

In the end, analysts say the ability to quickly ramp up capacity will matter as much as, if not more than superior display technology, giving an edge to Samsung and well-funded Chinese players like BOE.

Politically driven

Japan has had some success with government-led rescues in the past; Renesas Electronics, saved by INCJ in 2013, has turned around.

Renesas specialises in automobile-related semiconductors which are increasingly in demand for newer features such as assisted parking. But the world of LCD is far more cut-throat.

“Its investment in Renesas has been a relative success story,” said Andrew Daniels, a Tokyo-based managing director at Indus Capital.

“But make no mistake … LCD is a market that doesn’t have that underlying stability that Renesas has in automotive semiconductors.”

In the end, however, it will be a political decision, analysts and political sources say.

Sharp’s troubles come as Japan’s technology industry has struggled against more nimble Asian rivals, with brands that were once household names, such as Sony, losing cachet among global consumers.

Though he won’t stand in the way of a foreign buyer, Abe’s office would prefer to see Sharp rescued by a Japanese deal.

INCJ is also considering merging Sharp’s home appliances business with that of Toshiba Corp, which is eager to bolster its finances in the wake of an accounting scandal.

“In the end, they are trying to saving face for Japan. It’s politically motivated,” said Saito, the entrepreneur and government adviser.

Media reports put the INCJ offer at JPY 300 billion (roughly Rs. 17,430 crores), and sources say that bailout would also involve Sharp’s lenders offering at least JPY 200 billion, by converting debt to equity.

The Wall Street Journal on Thursday reported that Hon Hai, also known as Foxconn, was offering JPY 625 billion and promising not to replace top management at Sharp, an apparent attempt to soothe nationalist concerns.

[“Source-Gadgets”]

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | |||||