Since the new government at the Centre is settled, the focus now shifts on the execution of poll promises. BJP’s manifesto envisages overall infrastructure investment to the tune of Rs 100 lakh crore by 2022.

In the next three years, power, highways, airports, housing and urban infrastructure will be in the focus creating a strong demand environment for their respective value chains.

ICICIdirect expects PSE index to gain momentum as it observes a bullish phenomenon called Golden Cross on Nifty PSE index. When a medium-term moving average (50-day) crosses above a longer-term moving average (200-days) it is termed as a Golden Cross.

The brokerage has observed a similar crossover in many index constituents that collectively contribute 69 percent to the index weight, which indicates a bullish shift in trend direction.

There have been three instances of Golden Cross on the Nifty PSE index since inception and twice this has resulted in an average return of 18 percent in the following year.

This time as well, the brokerage expects the index to follow the same rhythm and return 18 percent in the coming year.

ICICIdirect has also recommended three PSE stocks that have given a Golden Crossover. They are Bharat Electronics, Power Finance Corporation, and NMDC. Here is what it has to say about each of them:

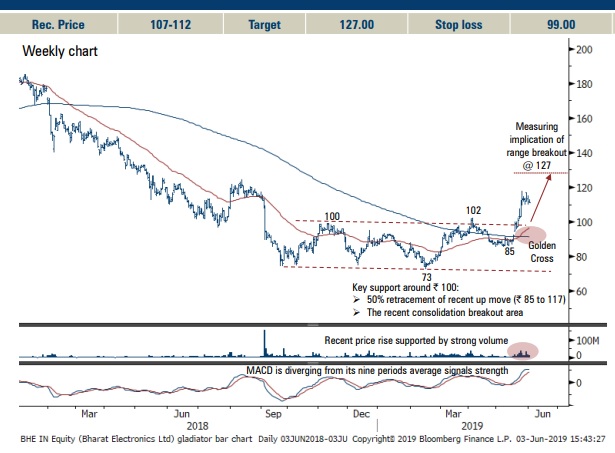

Bharat Electronics: Buy| Target: Rs 127| Stop loss: Rs 99| Upside: 16 percent

In the last week of May 2019, the share price has registered a breakout above the six months consolidation range (Rs 100-73) signalling reversal of the corrective trend, which offers a fresh entry opportunity.

The stock recently rebounded after forming a higher trough around Rs 85 and witnessed a faster retracement of the last falling segment (Rs 102-85) was completely retraced in just seven sessions highlighting a positive price structure.

The stock recorded a Golden Cross on the daily chart on May 20, when the 50-day SMA crossed above 200-day SMA, suggesting a turnaround in trend direction.

We expect the stock to continue its current up move and head towards Rs 127 as it is the measuring implication of the range breakout (100-73= 27 points) added to the breakout area of Rs 100.

Power Finance Corporation: Buy| Target: Rs 146| Stop loss: Rs 114.50| Upside: 14 percent

The stock resolved above its March 2019 high last week indicating the continuance of uptrend.

The share price is in a well channelled up move indicating a strong uptrend. Further, the rallies are getting bigger and corrections have been shallow that underscores the inherent strength.

Going forward, we expect prices to head towards Rs 150 over medium term which is 80 percent retracement of 2017–2018 decline (Rs 168-68). It also coincides with October 2017 swing high of 150.

NMDC: Buy| Target: Rs 117| Stop loss: Rs 93| Upside: 14 percent

The stock has undergone a secondary phase of correction where it has retraced 80 percent of last major up move and entered a base formation.

The potential double bottom formation signifies impending trend reversal, auguring well for next leg of the up move, thereby offering favourable risk reward set up.

Structurally, over the past 27 months, the stock has retraced 80 percent of the preceding 12 months’ rally (Rs 75-152). The slower pace of retracement signifies, robust price structure, paving the way to resolve higher.

We expect the stock to extend ongoing pullback and head towards 38.2 percent retracement of entire secondary corrective phase (Rs 163-89), at Rs 117. It also coincides with an identical high of November 2018 and March 2019.

Disclaimer: The views and investment tips expressed by brokerages on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

[“source=moneycontrol”]

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 31 | |||